How 501 C can Save You Time, Stress, and Money.

Wiki Article

3 Simple Techniques For Not For Profit Organisation

Table of ContentsThe 45-Second Trick For 501c3Not known Facts About Not For ProfitThe smart Trick of Google For Nonprofits That Nobody is Talking AboutAll about Irs Nonprofit Search4 Simple Techniques For Non ProfitNon Profit Organization Examples Can Be Fun For EveryoneThe smart Trick of Not For Profit That Nobody is Talking AboutNpo Registration Fundamentals Explained

Unlike many various other forms of contributing (via a phone telephone call, mail, or at a fundraiser event), contribution pages are extremely shareable. This makes them excellent for increasing your reach, as well as therefore the number of donations. Contribution pages enable you to accumulate and also track information that can notify your fundraising approach (e.The Basic Principles Of 501 C

donation size, when the donation was made, who donatedThat how much, how they exactly how to your website, web site) And so on, ultimately pages make it convenient and hassle-free for straightforward donors to give!Be sure to accumulate e-mail addresses and various other appropriate data in a proper method from the beginning. 5 Take treatment of your individuals If you haven't tackled working with and also onboarding yet, no worries; now is the time.

The Main Principles Of Non Profit Org

Deciding on a funding version is vital when starting a not-for-profit. It depends on the nature of the not-for-profit.As an outcome, not-for-profit crowdfunding is getting hold of the eyeballs these days. It can be used for particular programs within the organization or a general contribution to the reason.

Throughout this step, you could intend to think of landmarks that will suggest an opportunity to scale your nonprofit. When you have actually run awhile, it is very important to take some time to consider concrete growth objectives. If you have not already produced them during your planning, create a set of essential efficiency indicators and turning points for your nonprofit.

All About Non Profit Org

Without them, it will certainly be difficult to assess and track development in the future as you will have absolutely nothing to determine your outcomes versus and you won't recognize what 'effective' is to your not-for-profit. Resources on Beginning a Nonprofit in different states in the United States: Starting a Nonprofit Frequently Asked Questions 1. Just how much does it cost to begin a not-for-profit company? You can start a nonprofit organization with a financial investment of $750 at a bare minimum as well as it can go as high as $2000.For how long does it require to establish a not-for-profit? Relying on the state that you're in, having Articles of Incorporation approved by the state government might take up to a few weeks. As soon as that's done, you'll have to request recognition of its 501(c)( 3) condition by the Irs.

With the 1023-EZ kind, the handling time is commonly 2-3 weeks. Can you be an LLC as well as a not-for-profit? LLC can exist as a not-for-profit restricted responsibility company, nevertheless, it should be totally had by a solitary tax-exempt not-for-profit company.

All about Non Profit Organization Examples

What is the difference between a structure and also a not-for-profit? Foundations are typically funded by a household or a company entity, but nonprofits are moneyed via their revenues and fundraising. Foundations generally take the money they started out with, invest it, and afterwards disperse the cash made from those financial investments.Whereas, the extra money a nonprofit makes are utilized as operating prices to money the company's objective. Is it hard to begin a not-for-profit organization?

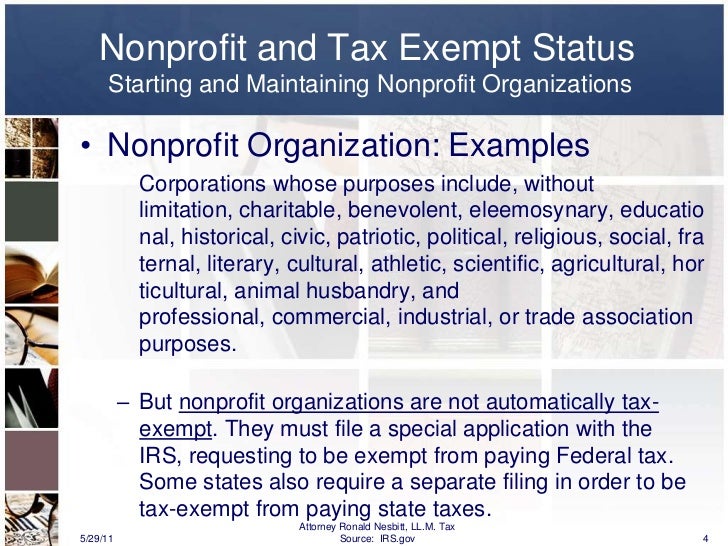

There are several actions to begin a nonprofit, the obstacles to access are fairly couple of. Do nonprofits pay taxes? If your nonprofit makes any kind of income from unrelated activities, it will certainly owe earnings taxes on that amount.

Things about Not For Profit Organisation

The function of a nonprofit company has actually always been to produce social change and lead the means to a much better globe. You're a pioneer of social adjustment you can do this! At Donorbox, we prioritize options that aid our nonprofits increase their donations. We understand that financing is vital when starting a nonprofit.By far the most common kind of nonprofits are Area 501(c)( 3) companies; (Area 501(c)( 3) is the part of the tax code that accredits such nonprofits). These are nonprofits whose objective is philanthropic, religious, academic, or scientific.

This classification is important due to the fact that private structures go through stringent operating guidelines and regulations that do not use see this page to public charities. Deductibility of contributions to a personal foundation is extra restricted than for a public charity, as well as private structures are subject to excise tax obligations that are not enforced on public charities.

Little Known Facts About Non Profit Organizations List.

The lower line is that private structures get much even worse tax obligation treatment than public charities. The main more helpful hints distinction between exclusive foundations and also public charities is where they get their financial backing. A personal foundation is typically regulated by an individual, family, or corporation, and also acquires most of its earnings from a couple of contributors and also investments-- an example is the Costs and Melinda Gates Foundation.This is why the tax law is so challenging on them. Many structures just provide cash to other nonprofits. Nonetheless, somecalled "operating foundations"operate their own programs. As an useful issue, you require at the very least $1 million to start an exclusive structure; otherwise, it's not worth the problem and expense. It's not unusual, after that, that a personal structure has actually been explained as a large body of money bordered by individuals who desire non profit court ordered community service near me several of it.

The Single Strategy To Use For 501 C

If the internal revenue service classifies the not-for-profit as a public charity, it maintains this standing for its very first 5 years, no matter the public support it really obtains throughout this time. Beginning with the nonprofit's 6th tax obligation year, it has to reveal that it satisfies the public support examination, which is based upon the assistance it gets during the present year and previous four years.If a nonprofit passes the examination, the internal revenue service will certainly remain to monitor its public charity status after the first 5 years by needing that a completed Schedule A be filed annually. Figure out even more regarding your nonprofit's tax obligation status with Nolo's publication, Every Nonprofit's Tax Overview.

Report this wiki page